How to switch your mortgage

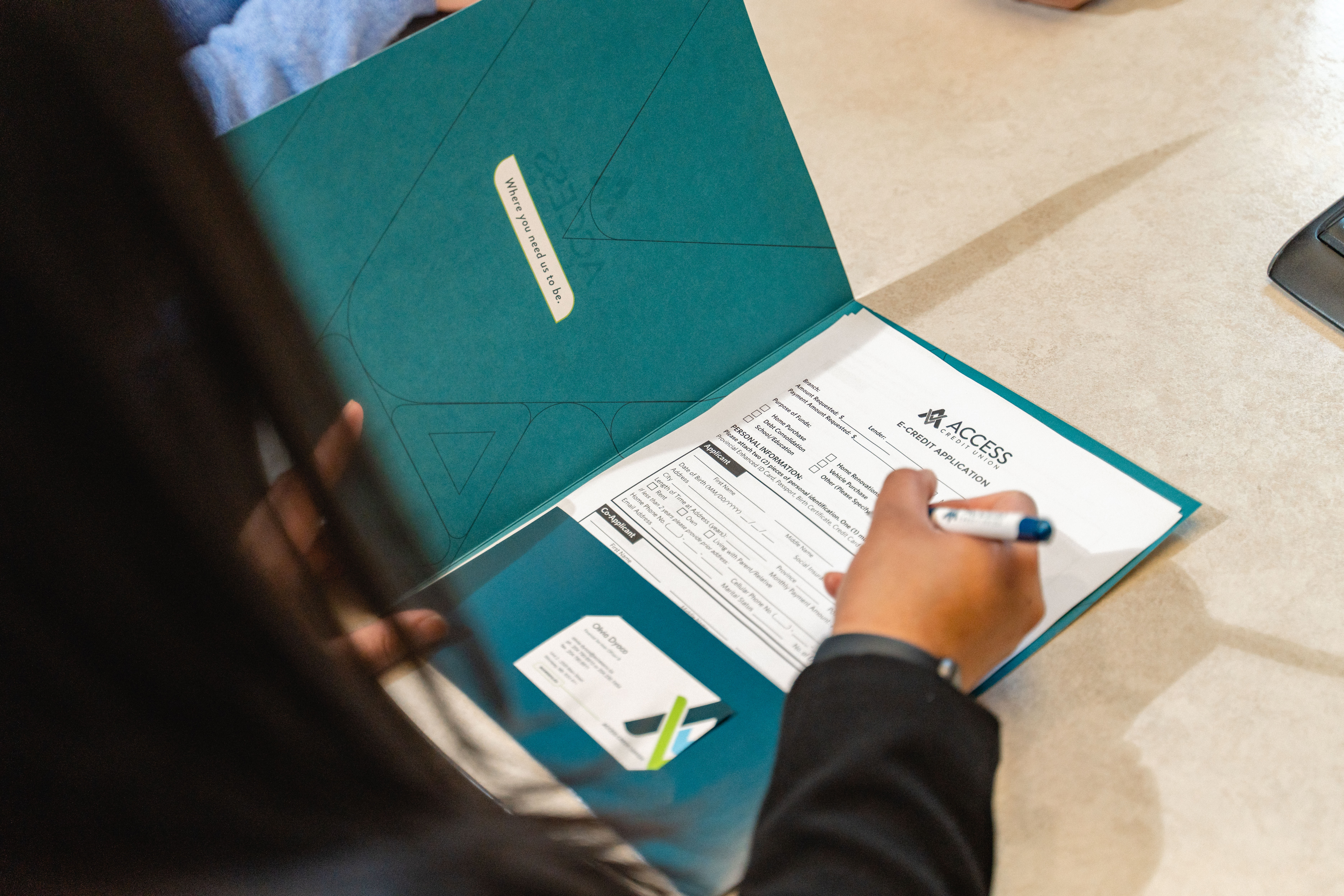

The process of switching your mortgage may seem daunting, but with the proper research and preparation, it can be a smooth and beneficial process.

Posts about:

The process of switching your mortgage may seem daunting, but with the proper research and preparation, it can be a smooth and beneficial process.

With the recent Bank of Canada’s most recent 0.25 per cent drop on prime rates, many are wondering if mortgage rates will further decrease over the rest of 2024. While it’s difficult to predict exactly what will happen with interest rates, it’s important to remember that those older rates were among the lowest in Canadian history.

What's the right option for you?

The Canadian government’s new First Home Savings Account (FHSA) came into effect on April 1, 2023. This new registered savings account allows prospective first-time home buyers to save for a down payment on a tax-free basis. FHSA contributions are tax-deductible (like an RRSP), and qualifying withdrawals to purchase a first home are non-taxable (like a TFSA).

Did you know there's a cool new way to help you save for your first home? It can be tough to juggle rent and other expenses while trying to put money aside for a down payment. But don't worry, we’ve got your back with a new government program that came into effect on April 1, 2023.

You’re thinking about buying your first home, but where do you start? Follow these steps if you are starting the process of buying your first home.

When your mortgage is up for renewal, you may feel uncertain about what steps you need to take. Here are some important factors to consider when your mortgage is up for renewal.

When you’re looking for a new house, it can be hard to find a place that has exactly what you want. Sometimes a house may need some renovations to make it the home you want. However, did you know that renovation costs can be rolled into your mortgage with a purchase plus improvement mortgage?