Loan or Line of Credit? Which is Right for You?

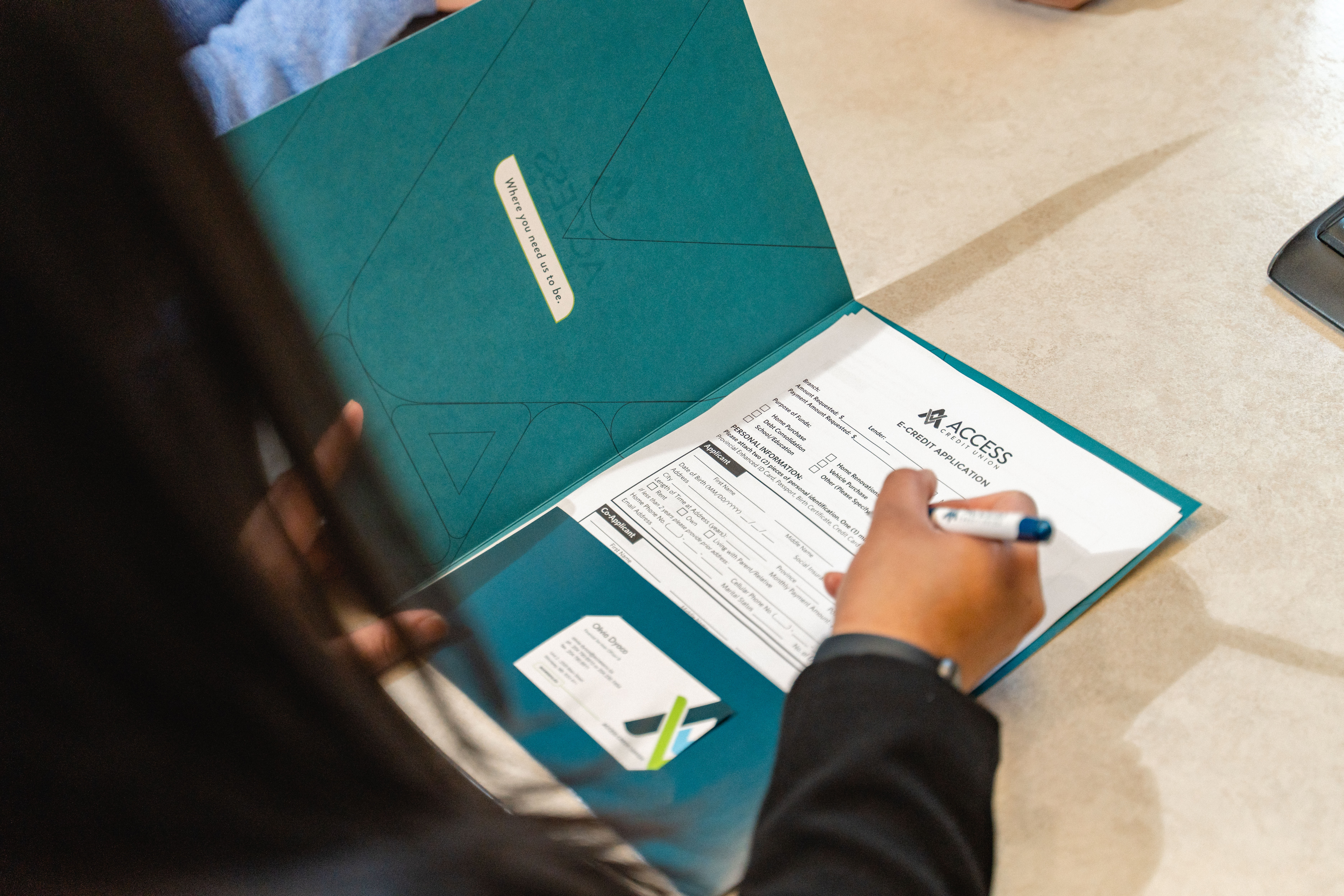

Do you have debt you are looking to consolidate? Perhaps there is a larger purchase you would like to make? Regardless of why you might be interested in exploring some of your available credit options, it’s important to know which vehicle is best for you. Some of the more typical avenues you might explore include personal loans or lines of credit.